REK YOUR CHEQUE: The recession just got real

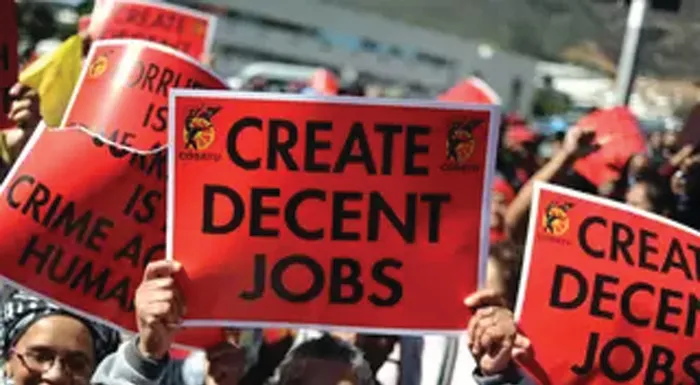

CRISIS: Jobs will be lost in SA CRISIS: Jobs will be lost in SA

The recession is real.

After two consecutive quarters of economic decline, South Africa has now entered a technical recession - and it would be silly to think that the lack of economic growth, and the effects of it does not affect us.

It does!

Many industries were negatively affected late in 2019, including:

The transport, storage and accommodation industry fell by 7.2%.

The agriculture, forestry and fishing industry contracted by 7.6%.

The construction industry also fell by 5.9%.

The electricity, gas and water industry contracted by 4%.

The manufacturing industry declined by 1.8%.

General government services decreased by 0.4%.

All of the above industries employ thousands of people, and if these industries are contracting, we are bound to see job losses.

We are only in the third month of 2020, and already South African companies have announced plans to cut more than 10 000 jobs.

Telkom, Massmart and Ellies have all started the process of letting people go, all in an effort to save costs and, presumably, keep their companies afloat.

In addition to this, the Covid-19 coronavirus is already having an impact on the economy.

The tourism industry in South Africa, which has been identified as an important growth sector, is set to lose around R200 million and thousands of jobs unless this deadly virus is contained soon.

The economic outlook is not good for us and from all accounts, South Africa will be downgraded to “junk status”.

If this happens, the rand will in all probability remain consistently weak, and the Reserve Bank will end up increasing the repo rate.

This in turn means that

interest rates will go up.

Homeowners will end up paying more on their bonds, rentals to tenants will be higher and car owners will pay more on their vehicles.

This will undoubtedly put a strain on already struggling households.

Yet, what amazes me most, is that mense just keep on spending!

Household spending increased by 1.4% in the final quarter of 2019, but in particular, spending on clothing and footwear was up by 8.5%.

All this while consumer debt in South Africa has increased to R1.72 trillion!

It’s like we just can’t be bothered by how bad things are, we just love spending money we don’t actually have.

South Africans continue to spend and live beyond their means and Sebastien Alexanderson, CEO of NDA, urges us to take stock of our finances before it is too late and shares some advice:

As simple as the task of drawing up a budget may sound, consumers should never underestimate the value of budgeting.

Everyone needs to stare their financial situation in the face.

Get rid of your debt, and ASAP.

Put as much money into your home loan as you can, you will end up paying it off sooner and save thousands on interest.

If you are fearful of the repossession of your assets, speak to a debt counsellor.

If you have an investment portfolio, speak to your financial

advisor about investing outside of South Africa.

Save as much as you can by doing things like switching off your geyser at certain times, carpooling to and from work, buying generic brands, downgrading your DStv package and cancelling

unnecessary subscriptions.

If you haven’t been to the gym, get out of that contract, and start walking or running at home instead.

Tap into your entrepreneurial skills and start creating an extra income. If you’re good at building cupboards or cooking and baking, use them to earn money.

The proverbial sh!t has hit the fan mense!

We as South Africans need to tighten our belts. People, we are in for a bumpy ride.