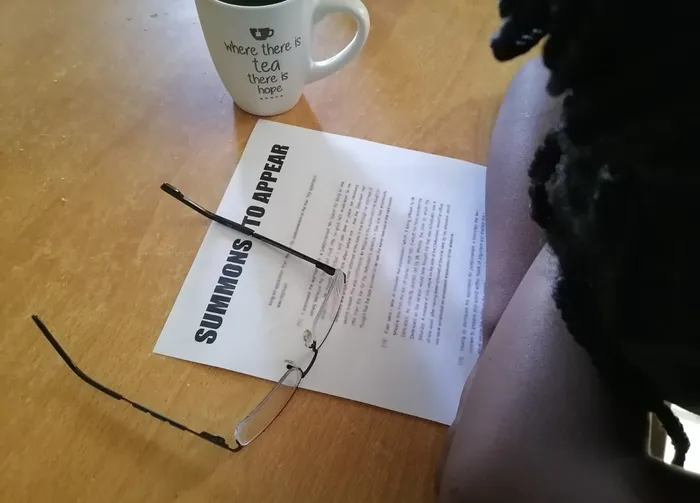

Rek Your Cheque: Learn to tackle your summons

WISE UP: You have 10 working days to inform an opponent you will defend against a summons

People are extremely reluctant to speak about their money problems.

This is strange, as there are millions of South Africans struggling with their finances.

Sadly, we have been conditioned to feel guilty and ashamed of a bad financial situation – and therefore rather remain silent, instead of asking questions, getting answers, and subsequently solutions to our financial problems.

I have compiled a list of frequently asked debt-related questions, and attorney Rynhardt de Lange has answered them.

Q I was served with a summons, how do I defend myself?

A Once you have been served with a summons, you have 10 working days from the date you received and signed for the summons to inform your opponent of your intention to defend the matter.

This is done by way of filing and serving a Notice of Intention to Defend.

This notice will form part of the summons with which you were served.

You can either complete a copy that is part of the summons, or alternatively you can draft your own notice, as long as it complies with the court rules.

Once you have drafted your Notice of Intention to Defend, you must serve your opponent with a copy of the notice, and you must file a copy with either the clerk or registrar of the court.

Q I have informed my opponent that I am defending the matter, are we ready to fight in court?

A No, unfortunately not yet.

Once you have filed the Notice of Intention to Defend, you have 20 business days to file your plea.

In your plea you will respond to allegations in the summons and also set your defence.

It is highly recommended that you consult with a legal professional before you file your plea.

There might be a defence that you can raise that you are unaware of, especially with regards to the prescription of debt and jurisdiction.

You will raise a special plea in such instances.

Q I have no defence, can I still file a Notice of Intention to Defend?

A Technically you can. It is, however, not advisable.

This will result in unnecessary legal fees that you will end up paying.

Make contact with either the plaintiff (the party who is taking legal action against you) or their attorney and negotiate a repayment plan.

You must do whatever you can to avoid getting a judgment granted against you.

Q I pulled my credit report and noticed that a default judgment has been granted against me. I have no idea where it came from. What is a default judgment?

A A default judgment is granted when you have been served with a summons and failed to defend the matter.

The plaintiff will ask the court by way of application to grant the judgment as the defendant (you) has failed to indicate whether or not they are going to defend the matter.

You can request the details of the attorney of record from the credit bureau.

Once you have the details, make contact with them, provide them with the case number (which you will be able to obtain from the credit bureau) and get copies of all documents.

You will then be able to see why default judgment was taken against you.

Q The default judgment that was granted against me was granted incorrectly and I have a defence. What can I do to remedy the matter?

A You may bring an application to rescind the default judgment.

You have 20 business days to bring the application to have the judgment rescinded.

If you do not bring the application within 20 days, you will need to ask for condonation in your application, in which you will set out your reasons why you have failed to bring the application within 20 business days.

Should the court grant the rescission application, you will then have to plea.

Q I was not physically served a summons – what now?

A You do not have to be served in person for all summonses.

If, for instance, you put down an address when you signed a contract, and you failed to notify all parties of your new address – they will be within their rights to serve the summons on the address which was given by you in the contract.

Always ensure that you inform all parties that you have an agreement with when your address changes.

This might seem very insignificant at the time, but can be a huge factor when legal action gets taken.

Q I signed surety for a loan that was taken out by a friend. He informed me that he cannot repay the loan. Will the creditor come after me?

A Creditors must first attempt to get their monies from the main debtor.

Should they fail in the process after they have utilised all their resources, they may start the collection process against you.

It is advisable to never sign as a co-debtor – you may end up not only losing family and friends, but money and a good credit rating as well.

With the internet and social media at our disposal, there is no reason why we should remain uneducated about our rights.

There is light at the end of the tunnel and there are solutions to the money problems we face.

If you want more insight into the above, visit Rynhardt de Lange’s website at www.dl-law.co.za.