Rek You Cheque: Money-Saving Tips

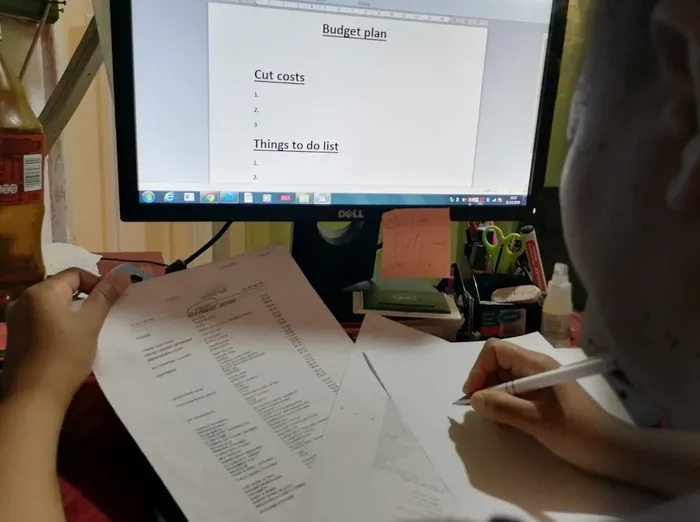

Caption: WRITE IT DOWN: Keep a budget and track all of your expenses

Be cautious.

Covid-19 numbers are rising in this second wave, and we have been urged to stay inside, sanitise, mask up and practise social distancing.

There is no excuse for unnecessarily roaming the streets in search of entertainment.

Our health comes first.

It doesn’t help trying to manage the little money you do have if you are severely ill or dead.

- Track your expenses and draw up a budget.

Being home is the best time to get a good overall view of your finances.

Write down everything you buy.

Keep all your slips neatly and start recording every cent you spend.

Do this for at least two weeks.

Believe me, you will be greatly surprised by how much you are spending.

- Stop all and any unnecessary spending.

Some people get into the mindset of “things are bad, we’ve had a rough year, I’ll feel better if I spoil myself and the children”.

This is not a wise approach, especially since we do not know how lockdown will be implemented in the next few months.

Rather put aside one set amount for holiday spending and work from there.

If you use all of this money before the holidays are over, then so be it, so spend wisely.

- Prioritise. Make a list of what your priorities are; this should include school fees, school clothes and stationery.

You must distinguish between needs and wants.

- Bored? Dig out the paperwork. If you find yourself with nothing to do, start digging out all your financial contracts and documents.

Go through the paperwork and make a note of who you owe what to. Write it down.

Make columns of the name of your creditors, how much your outstanding debt is, how much your monthly instalment is and how many more months you still have to pay.

Have a look at what your interest rate for every debt is.

Then start paying back the most expensive debt, i.e. the ones with the higher interest rates first.

You can’t find solutions to your financial problems if you don’t even know what the extent of your problems are.

Cancel subscriptions to apps you don’t need or use.

Stop your DStv or switch to a cheaper package.

Consider changing to store-brand or no-name brands for food, and household cleaners.

- Options

Use the internet to find out what your financial options are, specifically with regard to your debt. Use only reputable websites.

Debt counselling, a debt consolidation loan or even speaking directly to your creditors are all options that you should look at to manage your debt.

- Talk to your children about the financial situation in the house so that they don’t become anxious, will understand when you scale down, and don’t ask for or expect expensive items.

If things are tough and there needs to be a tightening of belts to get through the next few months, then your children must be aware of the situation.

- Save money on the way you do things.

While it’s not always possible to physically put money under the mattress or in a savings account, we can still save in other ways.

Switch off your geyser during the day. If you save R10 a day on electricity this way, it will amount to R300 a month that can go towards something else.

Medicines are costly. Make your own immune system boosters from natural ingredients.

Check for specials on cellphone data and airtime deals.

Sadly, the prices of food have increased tremendously during lockdown, sometimes by as much as 30% on basic items like rice and sugar.

By keeping track of specials at various grocery stores, you can save quite a bit of money on your weekly or monthly grocery.

- Energy saving tips

Sometimes the simplest actions have the most impact.

Turn off the lights when not using a room.

Only turn on your geyser for shower time.

Turn off standby appliances - like the microwave and cellphone chargers - to save electricity because it builds up over time.

Plan your meals and thaw frozen food overnight in the fridge or in hot water rather than the microwave.

Use energy efficient light bulbs and connections to reduce electricity usage.

It might involve some effort and initial financial outlay, but changing to energy saving light bulbs can save you a considerable amount of money in the long run.

The most important bit of advice that I can give is this – don’t spend money on things you don’t need.

Don’t try keeping up with the Joneses. There are no more Joneses!

*Moeshfieka Botha is Head of Research and Consumer Education at National Debt Advisors.

For more debt and personal finance information visit www.nationaldebtadvisors.co.za